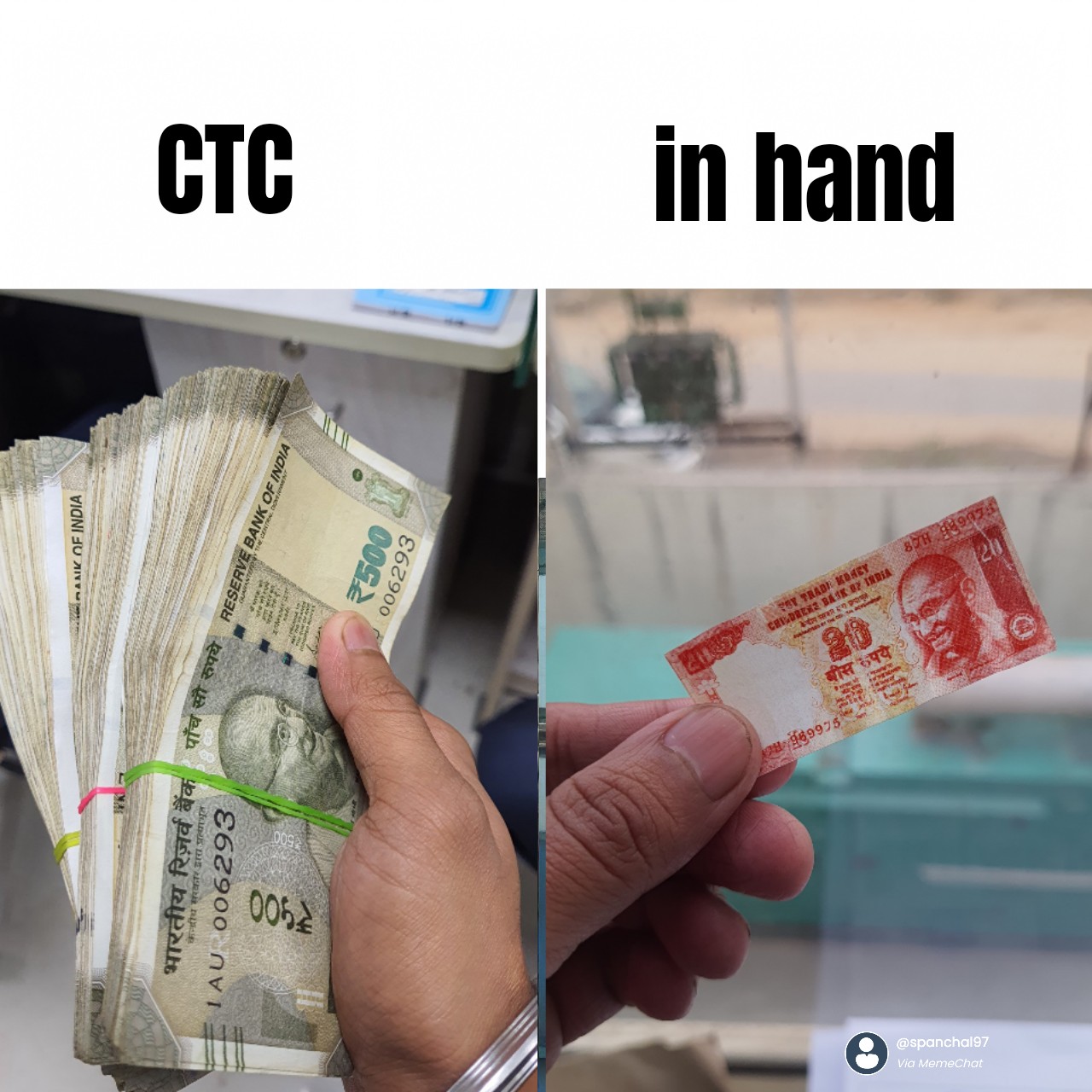

What No One Tells You About CTC vs In-Hand Salary

CTC ≠ Your Take-Home Pay. Here’s the Real Tea on Salary Breakups

You landed the offer. The recruiter says your CTC is ₹12 LPA. You call your parents, celebrate with cake, maybe even update LinkedIn.

And then… the first paycheck hits. And you’re wondering — where did all my money go?

Let’s decode the salary alphabet soup they don’t teach you about in college.

What Even Is CTC?

CTC = Cost to Company. It’s the total amount a company spends on you in a year — and we mean total.

This number is designed to sound impressive. But here’s what it often includes:

-

Basic salary

-

Bonuses (that may or may not be guaranteed)

-

Gratuity (you only get this after 5 years)

-

Employer PF contribution

-

Health insurance premium

-

Maybe even that Diwali gift voucher your manager forgot to hand out last year

The point? CTC is everything the company might spend on you — not what actually lands in your bank account.

What You Actually Take Home

Your in-hand salary is what’s left after deductions:

-

Employee PF contribution

-

Professional tax

-

Income tax (based on your tax slab)

-

Maybe ESIC, NPS, or other fine-print goodies you never asked for

If your CTC is ₹12 LPA, your in-hand salary might be more like ₹70K/month — or less. Yep, nearly 30–35% can disappear before payday.

The Problem? Most People Don’t Find This Out Until After They Join

CTC vs in-hand salary is one of the biggest shocks for freshers and even experienced professionals switching jobs.

You think you’re earning X, but your actual lifestyle budget is closer to X minus rent, groceries, UPI requests from friends, and existential dread.

And when that offer letter finally shows up, you’re too overwhelmed (or intimidated) to ask the right questions.

So What Can You Do?

If you’re job-hunting, negotiating, or even just considering a switch — it pays to know what questions to ask:

-

What’s the fixed vs variable component?

-

Are bonuses performance-based or guaranteed?

-

How much will actually hit my bank account each month?

-

Is the PF contribution on actual basic pay or a flat 12% of CTC?

-

Will they give me a breakup before I accept?

And if that sounds like too much to figure out on your own — well, you don’t have to.

Enter Mentoria Connect

Start with MOJO, our AI chatbot, it’ll ask the right questions to help you reflect on what you need from your next job: salary, stability, benefits, or flexibility.

Then speak to a mentor , someone who’s been through their fair share of confusing offer letters and disappointing paydays. They’ll break down the numbers, help you figure out what’s fair, and even prep you for negotiations.

Because knowing your worth is one thing. Asking for it confidently? That’s where most people get stuck.

Finally

CTC is not cash in hand. It’s the company’s invoice for you — not your personal ATM slip.

Don’t settle for a shiny number and financial confusion. Get real, get smart, and if needed — get help.

Mentoria Connect. ₹99. Full financial clarity (minus the HR jargon).