15 Common Myths About Banking Jobs Debunked

Jump to Section

When you think of banking jobs, what comes to mind? Fancy offices? Crunching numbers all day? A cushy 9-to-5? Well, let’s clear the air. There’s a ton of misinformation floating around about careers in banking, especially for coveted roles like SBI PO or RBI Grade B.

These myths often discourage talented students from considering careers in banking or, conversely, create unrealistic expectations that lead to disappointment. Based on years of experience working with aspiring bankers, it is evident that these misconceptions are very common. This blog addresses these myths head-on and will help you make an informed decision.

Myth #1: Banking Is All About Numbers

While having a good grasp of numbers is helpful, modern banking jobs—especially in roles like RBI Grade B—demand communication skills, leadership, policy analysis, and problem-solving.

For example, as an RBI Grade B officer, you’ll be analysing policies, supervising financial institutions, and representing India’s central bank. Banking jobs today are far more dynamic than sitting behind a desk crunching numbers.

Myth #2: Only Finance Graduates are Suited for Banking Jobs

One of the biggest misconceptions about banking jobs is that you need a finance or commerce degree. Guess what? Banks welcome grads from almost any background. Many banking exams are conducted every year which you can attempt even if you are not a finance or commerce graduate.

Whether you’re an engineer, a science student, or an arts graduate, you’re eligible to apply. Passion for financial markets and a willingness to learn is what really matters.

Myth #3: The Work Culture is Stuffy and Corporate

Gone are the days of rigid hierarchies and overly formal atmospheres. Modern banking is all about collaboration, innovation, and fresh ideas.

It’s all about group projects, cross-functional teamwork, and regular training sessions. Plus, many banks now offer mentoring programmes to help employees grow in their careers. Banking is adapting to the digital age, and the vibe is changing for the better.

Myth #4: Banking Means Perfect Work-Life Balance

If you think banking is a simple 9-to-5, think again. While government roles like RBI Grade B might have structured timings, most banking jobs come with their share of challenges.

From late-night month-end closings to surprise weekend audits, there are times when work spills into personal life. That said, learning to manage time effectively can help you strike a better balance.

Myth #5: The Pay Is Always Amazing

While high-ranking roles like RBI Grade B offer attractive packages, entry-level banking jobs often come with modest salaries. Salaries vary widely depending on whether you’re in a public or private bank.

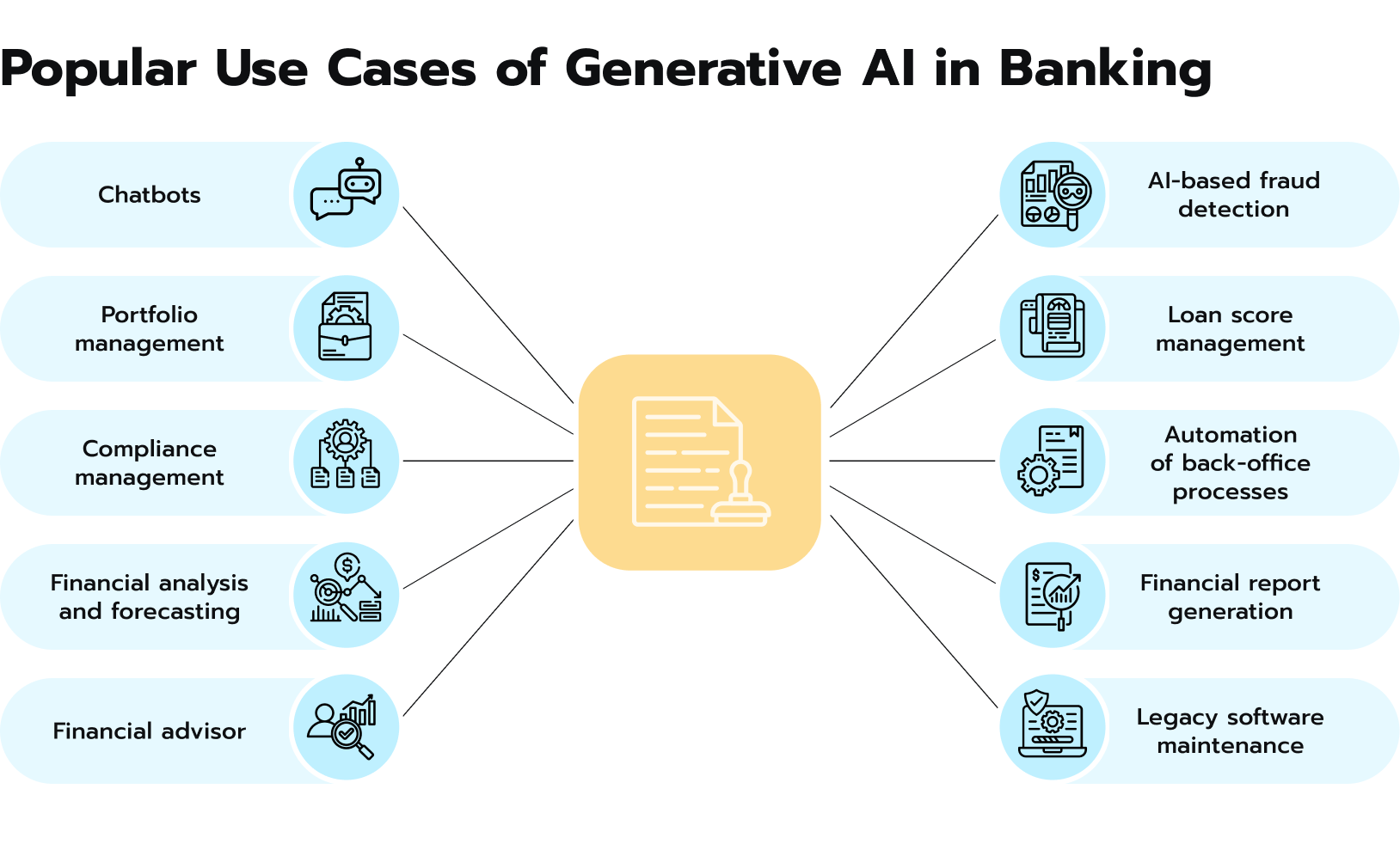

Myth #6: Tech Won’t Replace Banking Jobs

Think banking is immune to the tech boom? Think again. Automation is reshaping the industry, with digital banking, AI customer service, and blockchain streamlining many processes.

For instance, a branch that once needed 15 tellers can now operate efficiently with just three, thanks to tech advancements. Adapting to these changes is key to staying relevant in the industry.

Picture Credits: Avenga

Myth #7: Customer Service Is Always Nice

Not every customer is a happy one. From frustrated clients with transaction issues to borrowers struggling with repayments, patience is a must.

For example, explaining a fixed deposit renewal for hours to an elderly customer can be exhausting. But it’s also rewarding when you help someone navigate their finances.

Myth #8: Promotions Are Quick and Easy.

Climbing the ladder in banking isn’t always straightforward. Government bodies, like RBI, have set timelines, whereas private banks are less predictable.

Excellent performers can get stuck at the same level because of:

- Very few senior openings.

- Budgetary constraints

- Office politics Restructuring issues

Myth #9: Banking Knowledge Is Universal

Working in a private bank’s treasury may not necessarily work in a similar role in the public sector because different banking segments require different knowledge and approaches.

Myth #10: Banking Is Just About Money

Some of the most fulfilling moments in banking have little to do with money. Think about helping a small business owner secure their first loan or guiding a family through a financial crisis.

Banking is about building relationships, fostering economic growth, and helping people achieve their dreams.

Myth #11: Postings Are Always in Desirable Locations

Fresh graduates aspire to work in big bank branches. The reality is that banking often begins in obscure locations you’d have to search on Google.

This is typical in both public and private sector banks. Even top roles in SBI include:

- Initial postings in rural areas

- Frequent transfers that affect family life.

- Uncontrolled posting location

- Limited options to refuse transfers

- Adaptation to diverse regional cultures

Myth #12: Banking Jobs Are Recession-Proof

While banking is considered stable, it’s not immune to economic downturns. The 2008 financial crisis and recent digital transformations have shown that banking jobs can be vulnerable.

Banking jobs are vulnerable to:

- Global financial crisis

- Merger and acquisition impacts

- Bank consolidation exercises.

- Digital transformation layoff

- Economic policy reforms

Myth #13: Training Ends After Probation

This myth crumbles within your first year. Banking is not a direct learning activity; it’s an ongoing process. For eg. Even if you are in traditional banking, you might soon have to understand cryptocurrency regulations.

Modern and even experienced bankers struggle with:

- New compliance guidelines:

- New financial products

- Current technology platforms

- New security measures

- Changing Customer Expectations

Myth #14: The Culture Is Always Professional

Banking isn’t free from office politics or cultural challenges. It has its share of office politics and cultural challenges. And though banking may have many formal structures, the reality is that there will be:

- Interdepartmental rivalries

- Tension between Sales and Credit Teams

- Traditional vs. modern conflicts in banking

- Generation gaps in the approach

- Power dynamics dictating decisions

Myth #15: A Banking Job Equals Instant Social Status

The last myth is hard-hitting – many believe that a banking job, especially ‘prestigious’ positions like RBI Grade B, automatically grants high social status.

Although the respect it commands is still pretty much there, the ground reality has changed drastically.

- Traditional banking roles face competition from fintech startups ental rivalries

- Younger generations consider the banking profession less appealing than IT or consulting

- Customer respect isn’t a given anymore

- Social Media has made bankers more responsible

- Public perception varies with market conditions.

Conclusion

Banking isn’t a one-size-fits-all career. It comes with challenges, constant learning, and moments of both frustration and fulfilment. Whether you’re aiming for a prestigious role like RBI Grade B or exploring private sector opportunities, make sure you know the reality before stepping in.

Banking can be incredibly rewarding, but only for those ready to adapt and grow. So, is it the right choice? Only you can decide—but making an informed decision is key. That’s where Mentoria comes in, offering expert guidance and insights to help you navigate your career choices with confidence.