Is An Education Loan Worth It?

Graduated or not, we are sure you are thinking of your next step. Let us guess- is it studying abroad? Most of your friends would have their plans for studying abroad and there is no reason for you to think of it too! Some many universities and courses are better abroad- be it Psychology or Law, Banking or Investing. If you are really eager to move out, we are sure you have checked out all your uni options! Why wouldn’t you want to study at a university that provides the best education in your field? It means better exposure, better placements, learning to live on your own, learning to handle your expenses and whatnot! Earning a degree from a foreign university may sound fancy and seem aspirational, but there are so many expenses associated with it, and handling them is not always easy.

The chances of you not having the required finance available is high so how to deal with this? Yes, that’s right! Education Loan is the answer! The fact that this expense is high and can drain a good chunk of your corpus is also not surprising. Aside from the worry and anxiety that having a lot of debt can bring, student loans can make it difficult for people to make decisions and postpone significant life events. Are loans as good as they sound? Is an education loan really worth it? Let’s find out!

What Is an “Education” Loan?

Not everyone has access to the funding needed to attend a university overseas. Many students must take out loans to pay for their college expenses. Fortunately, student loans frequently provide favourable terms, and financial aid officials can support you in this process. An education loan is helpful at this point because pursuing higher education typically entails substantial costs. Banks offer student loans with low-interest rates for graduate/post-graduate, diploma, or professional studies. To fill the gap between the shortfall and the necessary amount, an education loan is essential in such a situation. By choosing an education loan, you can avoid depleting your family’s assets and not having to sell bonds, mutual funds, or fixed-income investments.

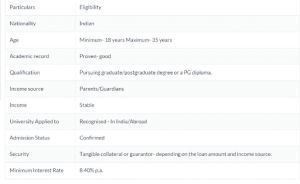

The banks that offer student loans must ensure that the applicant who is obtaining the loan will be able to repay it. For this, they confirm that the applicant is qualified and able to find employment after the course is completed and the moratorium period has passed. Now, this is how education loans work, let’s see the pros and cons so you can decide for yourself if it is worth the effort or not.

Here’s What We Would Say In The Favour Of Education Loans

While a “loan” sounds scary, here are some good reasons to take up an education loan!

1. Easy Access: Loans for education are now very simple to obtain thanks to banks and other corporate and public institutions. Within a week of the completion of the document verification process, an education loan is typically granted. For overseas students, the maximum loan amount is Rs. 1 crore, while for domestic students, the maximum loan amount is Rs. 50 lakh.

2. Mostly Low-Interest Rates: These loans feature relatively low-interest rates to make it easier for students to repay them. You can obtain a student loan at a lower, individualised interest rate than a personal loan or use a credit card to pay for your studies.

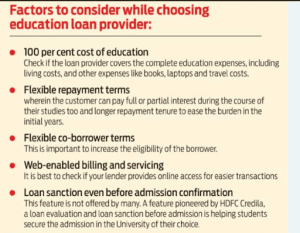

3. Pays For More Than Tuition: Your student loan could be used to cover other expenses like housing, books, and other study materials in addition to tuition. As a result, these non-fee charges won’t add to your financial burden.

4. Easy To Qualify: You must be at least 18 years old, be accepted into, or be enrolled in a recognised college to be eligible. You will require a cosigner to act as surety if you are a full-time student.

5. Pay After Education: You don’t need to worry about making an instant repayment because EMIs are only due when students finish their academic programme. Additionally, you can arrange your family’s budget in the medium and long term using the payback schedule as a reference. While an education loan typically has a duration of up to 8 years, the financial institution may later permit a longer extension.

The moratorium period is the time frame during which the student is exempt from making payments to the lender or the start of the EMIs. In order to allow students to focus on their studies, the moratorium period typically lasts the length of the course plus 6 months (with the option of an additional 12 months).

6. Sense Of Responsibility: An education loan is repaid by the primary borrower, the student, much like other loans. This means that the student must ensure that the loan is paid back to the financial institution that authorised the loan, and that it is paid back on time. A wonderful way for students to finance their education independently of their families is to take out an education loan. Additionally, when you pay back a loan, you begin developing a credit history. Future loans will be more affordable for them if they have a strong credit history.

Here Is Why You Should Give It A Second Thought!

Now that you know how an education loan could be good for you, let’s see the other side!

1. Restrictions: Banks may decline to lend loans because some colleges are only degree-granting organisations and not all international courses offer any placement assurance. After receiving a loan from a bank, many banks do not permit any changes to the course.

2. Debt: After taking out a school loan, the student’s life begins with debt, which is typically stressful. If you have student loan debt, you must make a monthly loan payment. The amount you owe could be significant, depending on how much you borrowed. This may prompt many students to accept whatever job they can find, regardless of pay, rather than looking for their ideal position and waiting.

3. Poor Credit: The average credit score for someone with student loans is lower than the national average since many student borrowers struggle to make payments.

Your financial life may be significantly impacted by your credit score. You may establish good credit by making on-time payments on your student loan obligations. However, failing to make payments can seriously harm your credit.

4. Sometimes High Interest: Because student loans are by their very nature unsecured, the interest rate is higher. The interest rate on the education loan is variable and fluctuates over time. The interest rate may vary depending on the banks and the loans one gets. For admission to colleges outside the category or list of top universities, the interest rate will be higher than 10%.

Pros And Cons Aren’t Enough, There’s More!

You have seen the pros and cons but is it enough for you to decide? Well, here are other things you should consider! Due to rising educational costs, the majority of students need loans. The likelihood of employment after completing the course is a crucial factor to take into account when applying for a loan.

What are the chances of you being able to repay the loan once your course is over? How long will it take you to completely repay it? Will you be able to find a job right after your course is over? You should definitely take out an educational loan if your calculations indicate that the rewards will outweigh the costs. Here are a few things that you need to consider before deciding if the education loan is worth it for you or not!

It is a mistake to enrol in a course only because the institute has ties to some financial firms and loans are simple to come by. You can become a victim of the education mafia if you do this. Numerous institutions that provide subpar education make an effort to entice students by highlighting their affiliation with banks. Based on your interests and skills, you should select the school and course.

Your goal should not be only to travel abroad when you take out a loan. Pick a subject that interests you and make it your career. Don’t let what the majority of people are doing deter you from pursuing a passion of yours. Only loans that can be paid back with future salaries should be taken out by students. Otherwise, the co-applicant, who is typically the parent, will be required to pay the balance.

- Thorough Research:

When submitting an application for a course, thorough research on the institution is crucial. Despite having an excellent reputation, some colleges could not have a strong placement programme. The right institution would be quite important when submitting an application for studies abroad. For this, you will have to research whether the course you are choosing has a good scope or not. This is the primary thing to consider before taking up an education loan.

- Avoid Top-Ups:

You can even contemplate getting a loan for graduation and using the top-up option to finish your post-graduate work. Adding to existing student debt is problematic because it adds to the liability. Finish the initial student debt before taking out a second one.

You can take up a part-time job to help pay some of your bills, you won’t need to borrow as much money later to repay the loan. Even at your college, you can be eligible for a work-study programme.

Decide For Yourself With Mentoria!

Firstly, evaluate whether spending so much on going abroad is worth it. Your research and weighing the pros and cons will help you decide. If you think you need a little more help then we are here for you!

Whether you choose to study in India or abroad, what is vital is that you are confident you’ve chosen the right career path for yourself. Just in case, you need some guidance, we, at Mentoria, are right here to help you.

Mentoria promises to handhold you during your career discovery journey – from the time you sign up until you get into a career you love.